Attention Dental Practitioners

Saving Your Retirement

Fund In A Traditional 401(K)?

Bad News: Your Money May Not Be Entirely Yours

Here’s why and what you should do instead

Yes, Send Me the FREE Book Now

Feeling lost with how to unlock your 401 (k)?

Get my FREE book on how to take checkbook control of your 401 (k) and IRA to help you have financial freedom.

Fill out the form below so I can FedEx you the book right away!

Being a dentist is hard work. In every sense of the word.

It’s demanding, both mentally, and physically.

You’re sitting in one position every day doing very precise work….

Handling patients of all temperaments with each threatening to make you lose your cool.

Not to mention the countless health hazards you expose yourself to in the process

It’s safe to say you deserve every penny.

And at least, the pay is decent, right?

You make enough money to pretty much guarantee yourself a debt and worry-free retirement.

I mean…with the sheer size and volume of money you’re stashing in your 401(k), it’s only logical you retire with complete financial independence….right?

Not quite.

A few years ago, I became obsessed with understanding how a traditional 401(k) works.

My research led me down a mile-long rabbit hole that exposed a lot of questionable (albeit legal) financial policies surrounding traditional retirement accounts.

Here’s the (highly) abridged version of what I found:

Once you put your money into a traditional-style 401(k), you immediately lose control over what your money does.

What assets it’s invested in…

How it’s invested…

For All Intents And Purposes, Your Money Ceases To Be Yours.

It goes straight into Wall Street where they take risky bets. Your interests? An afterthought.

And just like the meltdown of 2008, if the economy implodes again, your money could go up in smoke.

Your sweat and labor…gone. Now you have to work for yet more years to make up for it.

When I finally realized how this whole outfit really worked, I knew there had to be a better way.

A situation where you had much more control over your hard-earned dollars…

A retirement account where you have REAL control over what your money does…

Where you get to choose how your hard-earned cash is invested.

I was convinced a better option existed. There had to be a better option. The only question was… what was it?

The answer?

The Safe Harbor Enhanced Qualified Retirement Plan or eQRP for short

“I moved my EVERFI assets into an eQRP and have been a happy customer ever since. Anytime I need anything the eQRP team is there for me.”

Travis Godon

“I love eQRP team customer service. I’m never waiting on hold, and they always call me back. eQRP is not afraid to give advice and help guide me in the right direction.”

Jon Yost

“When you’re told to put money into your 401(k) you gain capital and realize your money is locked up. With an eQRP, I can invest my money the way I want to invest it. I love the education the team has provided to help me understand the options on how to access a W-2 job capital and my big pool of money.”

Ben Dickey

“When you get into the eQRP program you get ownership on how you direct your funds.

Brett Binkley

“I have saved a tremendous amount in taxes. The company offers white glove treatment to the people that are eQRP members.”

Bill Coppedge

“Far beyond retirement, the Badger Tribe (eQRP Member’s Exclusive Community) focuses on your entire life and education and cares about your surroundings.”

Kevin Malmgren

“I love eQRP because it keeps us from paying UBIT tax and is the Ferrari of retirement accounts.”

Bronson Hill

“What I love about the eQRP team and Honey Badger Tribe is that when I hand them a client I fully trust they are taken care of for a lifetime.”

Dave Zook

“I read the QRP book and gave this book to my clients. Because I’m an asset and protection trust lawyer, the whole lawsuit-proof aspect is incredible. eQRP offers lawsuit asset protection.”

Kevin Day

Here’s the difference between a Safe Harbor eQRP and a traditional 401(k)

Traditional 401(k)

Safe Harbor eQRP

Eliminate custodial or management fees because you are in charge of your investments.

You decide where and when to invest your hard-earned money

They keep you working all your life under the guise of investing in your “nest egg”... which can be shattered by the next economic crisis.

Your money is protected from economic whims

They give you very few investment options, (which are crumbs left by the elites), that don’t give you protection against market crashes.

Invest in real estate, precious metals, and cryptocurrency - completely tax-free

With a Safe Harbor eQRP

Your money, is protected from liability, and Wall Street vultures.

Your money, is protected from liability, and Wall Street vultures. No hidden charges and 0 management fees.

No hidden charges and 0 management fees. You can invest in profitable real estate, completely tax-free

You can invest in profitable real estate, completely tax-free

I call it the Gold Standard of retirement accounts.

I spent two-plus years researching how eQRPs work, and how regular dentists and dental practitioners like you can make your money work for you…

…Instead of leaving it all to the mercy of grubby Wall Street Investors with nothing but selfish profit on their minds.

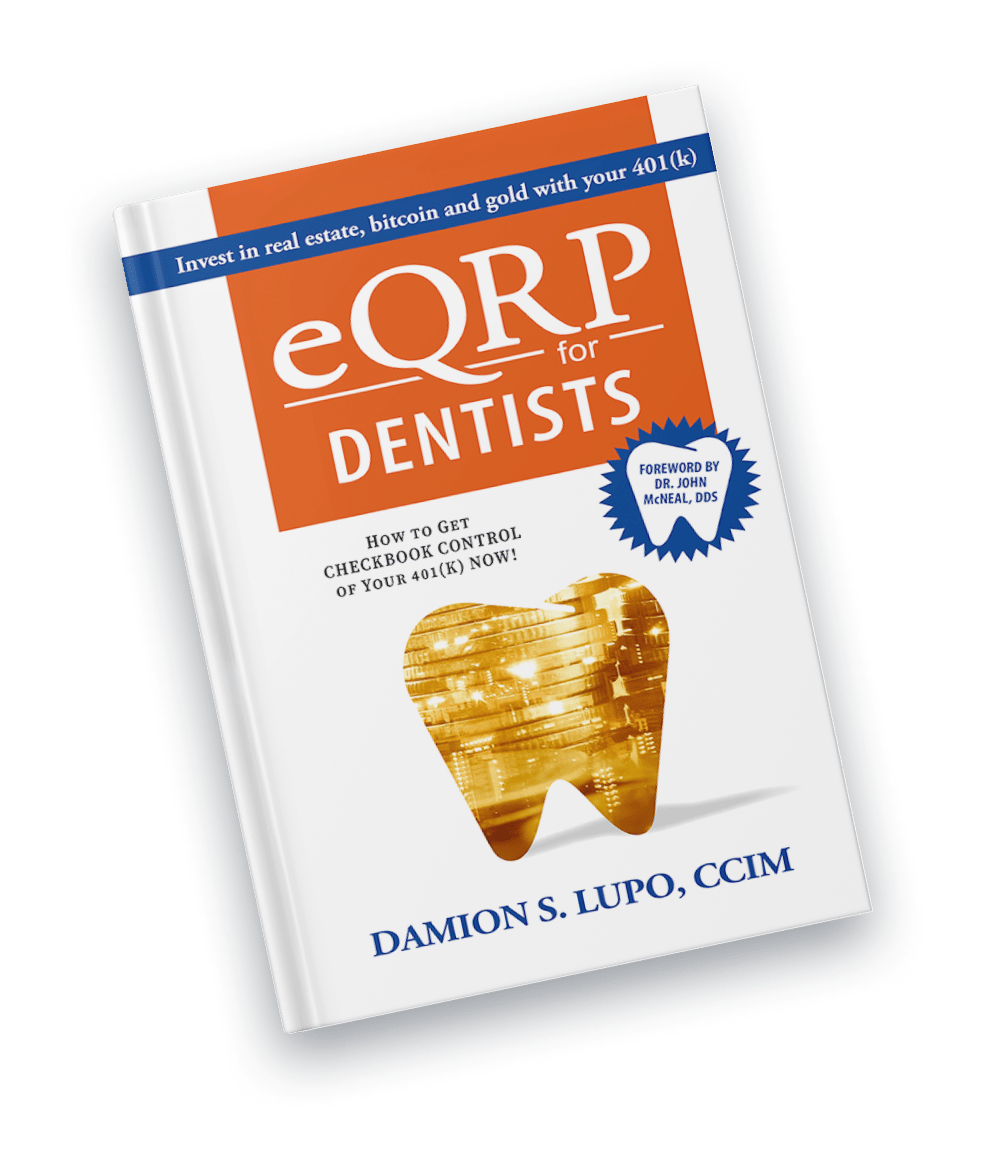

I distilled this entire knowledge in my new book, which I’d love to give you for FREE

Allow me to Introduce…

In this Book, You’ll Discover:

How to get complete control of your retirement money right now (and stop leaving it up to anybody else who may or may not have your best interest in mind).

How to get complete control of your retirement money right now (and stop leaving it up to anybody else who may or may not have your best interest in mind). How to diversify your investment portfolio (so you always have a plan A, B, and C to count on regardless of the state of the market).

How to diversify your investment portfolio (so you always have a plan A, B, and C to count on regardless of the state of the market). How to set up Roth eQRPs for your children (and get a $30k tax deduction on each).

How to set up Roth eQRPs for your children (and get a $30k tax deduction on each). How to legally live tax-free for life (a Roth account is included in all eQRPs).

How to legally live tax-free for life (a Roth account is included in all eQRPs).

And so much more…

Feeling lost with how to unlock your 401 (k)?

Get my FREE book on how to take checkbook control of your 401 (k) and IRA to help you have financial freedom.

Fill out the form below so I can FedEx you the book right away!

“When you’re told to put money into your 401(k) you gain capital and realize your money is locked up. With an eQRP, I can invest my money the way I want to invest it. I love the education the team has provided to help me understand the options on how to access a W-2 job capital and my big pool of money.”

Ben Dickey

With eQRP, you can easily achieveFIRE—Financial independence and Retire early.

Because you’d be free from the shackles of those greedy regulators.

Even if you choose not to put down the handpiece for good, you can slow down comfortably…

Working 1, 2 or 3 days a week, doing it because you enjoy it not because you have to.

We both know dentistry is hard work, both physically and mentally.

You don’t have to spend your entire life working your back off, saving for retirement, and still end up short-changed by these greedy people.

However, you now have the chance to take back control, and actually secure your Future and your Today

Take A Peek Inside the eQRP Book for Dentists

Avoid the UDFI Tax Without Breaking A Sweat

Avoid the UDFI Tax Without Breaking A Sweat

If you have a self-directed IRA, then you’re paying this—whether or not you realize it. But we’ll teach you how to avoid it, legally. Take Your Money Back From Wall Street

Take Your Money Back From Wall Street

Discover how you can get your 401(k) and IRA money OUT of Wall Street and straight into your hands where it belongs. Defer Tax Payments On Up to $100k+ Per Year

Defer Tax Payments On Up to $100k+ Per Year

We get it. The rich get out of paying for a lot if we’re being honest. So, why shouldn’t a “regular” person earn $100k or more? Learn elite tricks and use them yourself to even the playing field for once.

Feeling lost with how to unlock your 401 (k)?

Get my FREE book on how to take checkbook control of your 401 (k) and IRA to help you have financial freedom.

Fill out the form below so I can FedEx you the book right away!

Now, Fair Warning

I cannot guarantee that this book will stay free much longer. We only allocated a certain number of books to be given out for free.

When that stock runs out, we’d have to slap a price tag on further shipments. So act fast and get yours while it’s still free.

Get the free book; eQRP for Dentists today; no credit card required.

Feeling lost with how to unlock your 401 (k)?

Get my FREE book on how to take checkbook control of your 401 (k) and IRA to help you have financial freedom.

Fill out the form below so I can FedEx you the book right away!